Christeen Seymour CPA PLLC Dental CFO Advisory Tax Savings and Monthly Accounting - CALL TODAY 281-969-7976

Proactive Tax-Saving Strategies and Complete Monthly Accounting Solutions 👉 Dental Practice Owners, New Dentists, Independent Dental Contractors, Oral Surgeons, Orthodontists,, Family and Pediatric Dentists👈

Stop Overpaying the IRS. Start Paying Yourself First.

We help 6-and 7-figure dental practice owners legally reduce taxes by $20K-$50k/tear and run-bank- ready financials -without the hassle.

For Dental Practices, New Dentists, Independent Dental Contractors, Oral Surgeons, Orthodontists and Family/Pediatric Dentists nationwide.

Every business faces taxes, but Christeen Seymour CPA PLLC has the advanced tax planning strategies to minimize the impact on your dental practice. Serving dentists nationwide. Our team is deeply knowledgeable in both federal and state tax laws and works diligently to secure significant savings for you. We leverage every available tax break, deduction, and incentive to reduce your tax burden, helping your practice become more profitable while increasing your personal income.

Get started today with our core accounting services and PROFITAX Solution for complete tax reduction strategies and bank ready financials.

Simplified Financial Solutions for Your Dental Practice

💼 Quarterly Tax Blueprint

We identify, plan, and implement your tax savings every quarter.

Our Key Services:

💼 Quarterly Tax Blueprint

We identify, plan, and implement your tax savings every quarter

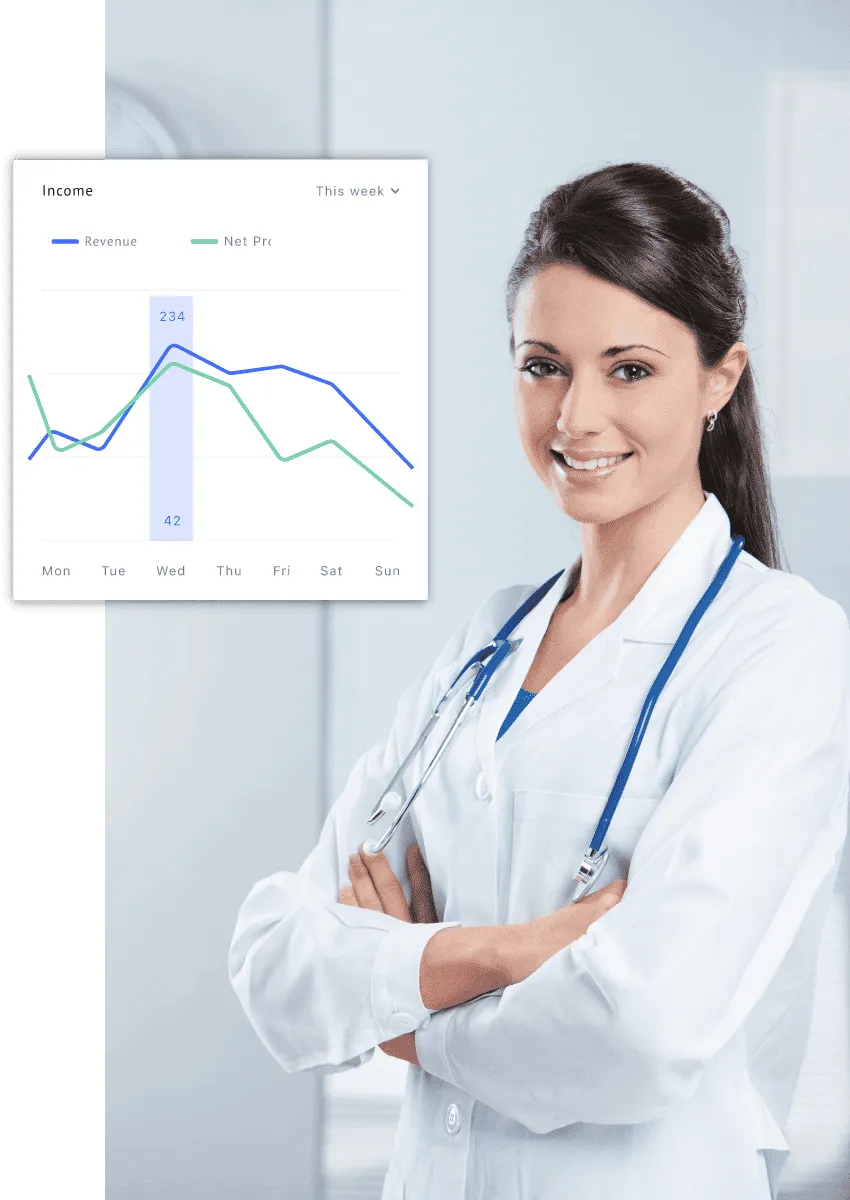

📈 KPI & Cash-Flow Dashboard

Track profits, taxes, and cash flow in real time – bank ready.

🏛 S-Corp Optimization

Optimize reasonable compensation and distributions for maximum savings.

⚙️ Section 179 & Bonus Strategy

Plan timing for equipment deductions before year-end.

💰 Retirement Plan Design

Build 401(k), Cash Balance, or SEP/SIMPLE plans for your practice.

📞 Unlimited Advisory + Annual Return

Full CPA support year-round – no surprise bills.

Real results from Dental Clients

Pediatric practice saved $27,492 in 12 months using entity & 179 optimization.

Orthodontic group cut their effective tax rate from 32% → 24% after payroll restructuring.

Startup dentist freed up 10 hours/month by outsourcing bookkeeping and quarterly reporting.

Why Dentists Choose our Core Accounting and PROFITAX Tax Reduction Solutions

We serve 6- and 7-figure dental practice owners looking to work with a CPA who becomes their CFO-partner.” Add ROI guarantee (“If we don’t identify $10K in legal savings in 12 months, we won’t invite you into the program.”)

Real results from Dental Clients

Pediatric practice saved $27,492 in 12 months using entity & 179 optimization.

Orthodontic group cut their effective tax rate from 32% → 24% after payroll restructuring.

Startup dentist freed up 10 hours/month by outsourcing bookkeeping and quarterly reporting.

Monthly Bookkeeping

Focus on Running Your Business. We provide monthly accounting/bookkeeping services and issue bank ready financial statements.

Expert Tax Preparation

Financial Statements

Each month we provide a Profit and Loss statement, Balance Sheet and Statement of Cash Flows. Bank Ready

Year End Financial Analysis

Tax Reduction Planning

Take advantage of expert tax planning strategies to reduce your tax liability.

Business Advisory Services

We will setup your SEP IRA and other accounts.

The Real Cost of “Set-and-Forget” Accounting

PROBLEMS:

Missed Section 179 / bonus depreciation on new chairs, x-ray, CAD/CAM

Wrong entity or payroll split inflating self-employment tax

No quarterly plan → expensive year-end surprises

SOLUTION:

The PROFITTAX Private Client System analyzes your books quarterly, implements legal strategies, and keeps you compliant—so you keep more of what you earn and scale with confidence.

Built for Dental Practice Owners and Independent Dental Contractors

Our CORE accounting and PROFITAX Tax Reduction solution is designed exclusively for dental professionals.

Monthly Bookkeeping, Expert Tax Preparation, Business Advisory, Tax Reduction Strategy, Financial Statements and Year End Financial Analysis. All customized for your specific practice.

We will handle all Your Tax & Accounting Needs.

Handle the Monthly Bookkeeping:

Tax Planning & Reduction Strategies:

Provide Financial Reports :

Financial Reporting to Assist you in making more informed decisions. Bank-Ready

Business Advisory Services :

Year End Financial Analysis :

Are You Tried of Overpaying

in Taxes Year After Year?

Our CORE accounting and Expert Tax Reduction Strategies is what you need. We will implement the best tax saving strategies for you each year that we identify during your tax the planning session with our CPA.

- Are you overpaying in taxes each year?

- Is your Accountant too busy?

-

We usually identify thousands a year in savings

Grow a More Profitable Business & Know when to Scale

Never Overpay in Taxes — You get pro-active analysis & strategy implementation to mitigate taxes.

Get Pristine Financials — Running & scaling a business is much harder without up-to-date financials.

Never Lift a Finger — We’ll handle setup, monthly accounting, software fees, schedule your tax planning sessions and provide reports that will save you and your team a ton of time.

Here are Some of the Tax

Reduction Strategies We'll Utilize:

them perfectly while keeping you compliant.

S-Corp Optimization and Entity Structuring

Section 179 & Bonus Depreciation - Maximize Equipment write-offs

Income Shifting

Hiring Kids & Spouses Legally

Small Biz Retirement Plans

Vehicle & Equipment - Turn Expenses into Deductions

Pro-Active Tax Strategies That Save Dentists Thousands

Dental Practice Owners and Independent Dental Contractors

It's time to take action to Reduce your

Taxes & Never Worry About Accounting Again. Let us handle all your tax and accounting needs. Find out how Our core accounting and tax reduction strategies will help you reach your financial goals and leave a legacy for your family.

Tax Return Preparation & Tax Reduction Strategies for Dental Practice Owners and Independent Dental Contractors are included in our core accounting monthly service.

The Bad News:

The Good News:

Dental Practice Owners: Save Thousands with an SCorp

Hear What Our Customers

Are Saying About Us

Services

Monthly Accounting

Tax Preparation

Advisory Services

Payroll Services

Tax Reduction Planning

Business Startup Services

© Christeen Seymour, CPA, PLLC 2022

Powered by Luxvoni.com where boundaries are not included